DECODING THE MARKETS

A symbiotic relationship between price action and trend following

Roberto Marrocco, CFA

Chief executive and investment officer

What are the markets telling us? How do we differentiate between noise and genuine shifts when it comes to trading?

Ask the following questions to any investor or fund manager and you will find yourself with a panoply of different answers, each based on different interpretations, in turn based on a multitude of economic, geopolitical, and financial factors.

Surprisingly or not, all answers would probably be valid. However, the complexities of the markets and the daily influx of new financial and economic information can make it difficult to build an objective and clear framework for decision‑making. This is especially true when it comes to trading and decoding the markets.

That is why, at Mageska, we opted for price action analysis to study stock movements and adopted trend following as a trading strategy.

Our goals: reduce market noise and capture discernible signals!

Price action drives the narrative

At Mageska Capital, we are avid believers that price action is a valuable gauge of market sentiment and can provide deeper insights into a stock’s performance than only relying on its fundamentals.

By focusing on price for trading signals rather than relying solely on lagging indicators (e.g. interest rates, corporate profits, earnings per share, etc.), we give ourselves the opportunity to capture significant portions of price trends, whether they be short-term fluctuations or longer‑term trends.

Moreover, as summed up by the managers at Three Body Capital, “price is function of the bids, which are function of each participant’s “fair value” prior assumption, which are themselves a function of the nature of each participant” 1.

As such, by looking at price, we also gain insights into the aggregate market assumptions, rather than leaning exclusively on our own perspective. From our viewpoint, it constitutes an advantage over the determination of our own “fair value”, which is often a notion better carried out in theory than in practice.

Ultimately, we believe that price drives the narrative, and not the other way around. As per Ben Carlson, Director of Institutional Asset Management at Ritholtz Wealth Management “if stocks rise, the narrative will become even stronger. If the rally peters out and stocks resume their descent, the negative narratives will return.” 2

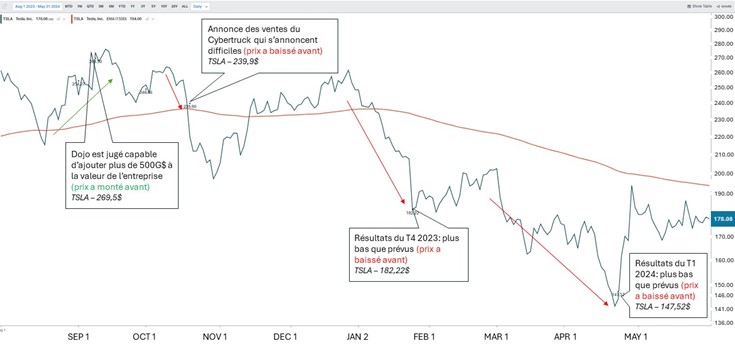

One perfect example to substantiate the latter is Tesla’s stock behavior over the last three quarters:

Source : Koyfin

Price action clearly confirmed the underlying negative fundamentals well before the news arrived.

Capturing market momentum: the art of trend following

Price action analysis forms the foundation of trend following strategies. It serves as the lens through which patterns are identified, which in turn translates into market momentum and eventually, into established trends.

At Mageska, we harness the power of AI to identify such patterns and benefit from this trading approach. Our proprietary tool, M-LAB, analyzes vast amounts of historical price data. It uses advanced algorithms to uncover patterns and select the best-performing securities. As a pure mathematical model, M-LAB minimizes the influence of emotions and allows us to make well‑informed trading decisions.

By combining the analytical power of price action with the discipline of trend following, we can navigate the dynamic landscape of financial markets with greater precision and profitability while also reducing portfolio drawdowns and volatility, offering investors a smoother ride and steadier returns over time.

Sources:

1 Three Body Capital Article – What makes price?

2 Ben Carlson – Narrative Always Follows Price in the Markets – A Wealth of Common Sense